Investment Scams

Be suspicious of anyone that offers you easy money. Scammers are skilled at convincing you that the

If you are earning more than you need to live comfortably, salary sacrificing may be an attractive option to reduce your tax, boost your superannuation and prepare for a more comfortable retirement later on.

Salary sacrificing simply involves having part of your salary paid into a superannuation fund by your employer rather than receiving it as income. These contributions are not included as part of your assessable income, reducing your income tax burden.

But you can’t have it all your own way. Salary sacrificing is such an attractive strategy but beware of exceeding the concessional contributions cap which will negate any tax benefits. Staying under your applicable limit will mean salary sacrificed contributions attract only a 15% contributions tax. This is significantly less than you would pay in income tax if you received it as income. You will also need to have a formal agreement in place with your employer. And importantly, you won’t be able to access the money until you reach your preservation age. Depending on your year of birth you may have to wait until you turn 60 before you can access your super.

Case study

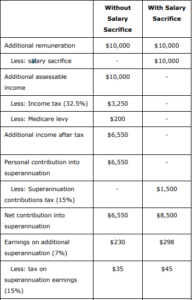

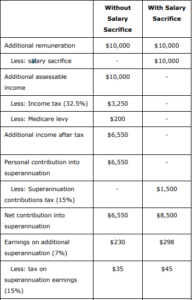

Karen is promoted to a senior management role and her annual salary increases from $70,000 to $80,000 per annum. She is offered the option of having the additional remuneration paid direct into her superannuation (salary sacrifice) or receiving it as income, which she could

then contribute into superannuation. The following table compares the different outcomes of the two strategies including the first year’s earnings on the contribution.

There is an obvious win-win for Karen by sacrificing the additional remuneration to super – she pays less tax and increases her superannuation balance by a larger amount.

If you want to take advantage of saving tax through salary sacrificing to super, come and talk to us. We can assist you in determining if it’s right for you, and if so, set up an effective arrangement to maximise your benefits in both the short and long term.

Warm Regards

Chris Connolly Dip.FS AFA

Principal Financial Adviser

ABN: 68 581 763 266

Phone: (03) 9591 8000

Fax: (03) 9530 8375

PO Box 5074, Bentleigh East Vic 3165

Email: chris@connollywealth.com.au

Website: https://connollywealth.com.au

Sources:

Australian Taxation Office www.ato.gov.au

Salary sacrificing super

In this article we have not taken into account any

particular person’s objectives, financial situation or

needs. You should, before acting on this information,

consider the appropriateness of this information

having regard to your personal objectives, financial

situation or needs. We recommend you obtain financial

advice specific to your situation before making any

financial investment or insurance decision.

Be suspicious of anyone that offers you easy money. Scammers are skilled at convincing you that the

Easy steps to plan and manage how you spend your money. Having a budget helps you to feel in

When we get to the end of another year, we often feel the stress and events of the last 12 months

Level 1, 441 South Road Bentleigh VIC 3204