Investment Scams

Be suspicious of anyone that offers you easy money. Scammers are skilled at convincing you that the

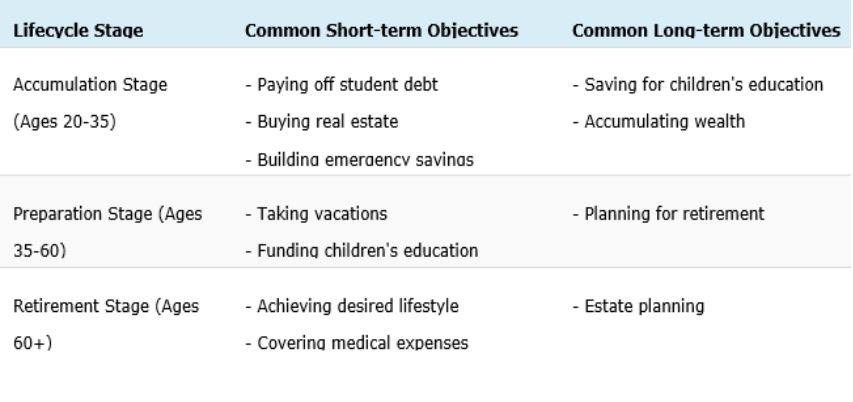

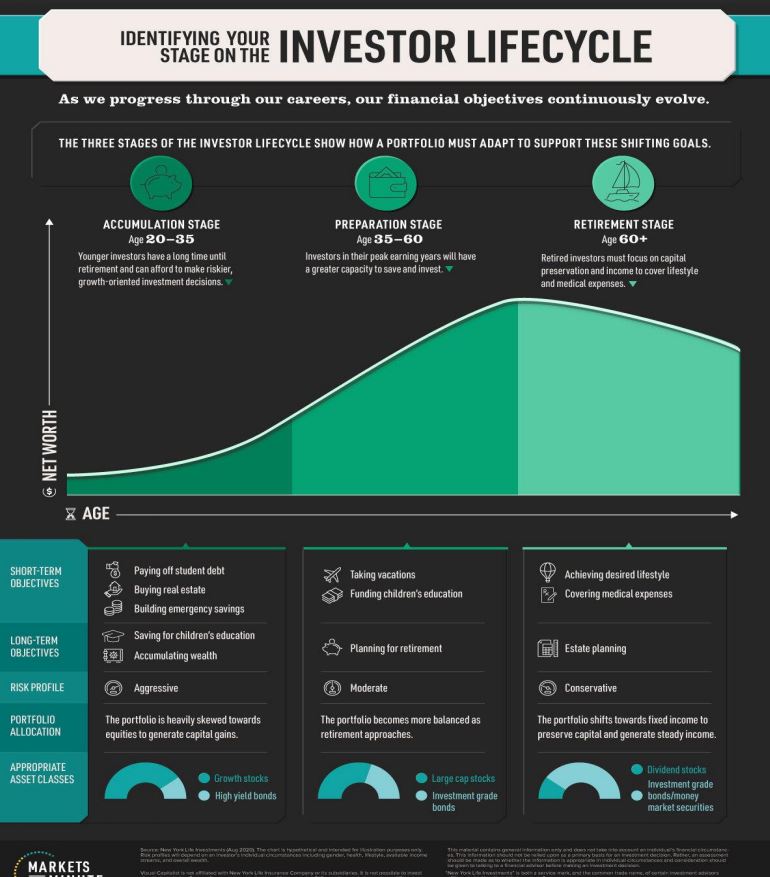

As people age and progress through their careers, their financial goals continuously evolve. Understanding one’s current goals, while also planning for those in the future, are two important elements of financial planning.

In this Markets in a Minute chart from New York Life Investments, we outline the investor lifecycle, a three-staged theory designed to help individuals optimize their portfolios as they age.

The Three Stages

Each lifecycle stage is associated with a set of distinct objectives that, when incorporated into a long-term investment plan, will guide the investor through to retirement.

These age-sensitive objectives will ultimately shape an investor’s risk profile and portfolio allocations.

The Accumulation Stage

Individuals in the accumulation stage are just beginning their careers, meaning they have a relatively low net worth and a long time horizon until retirement. With over 30+ working years ahead of

them, it’s often an ideal time for these investors to build more aggressive portfolios geared towards capital gains. In practice, this usually results in a significant allocation to equities. This is because equities boast a relatively higher return potential, making them suitable for younger investors looking to accumulate wealth. Their long time horizons also allow them to ride out periods

of short-term volatility that equity markets sometimes experience.

The Preparation Stage

Individuals in the preparation stage will likely reach their peak earning years, and as a result, will have a greater capacity to save and invest. Getting the most out of this capacity will require these investors to establish a longterm financial plan centered around retirement. Because they now face a shorter time horizon, they may want to consider a more balanced risk profile. While equities may still play a major role in these individuals’ portfolios, the asset class’s overall allocation is often dialed back in favor of safer securities such as investment-grade bonds.

The Retirement Stage

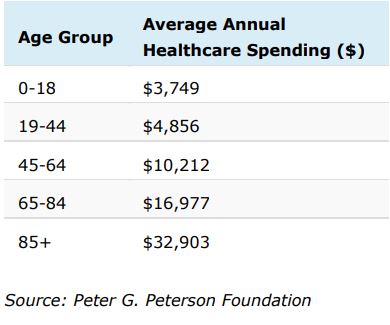

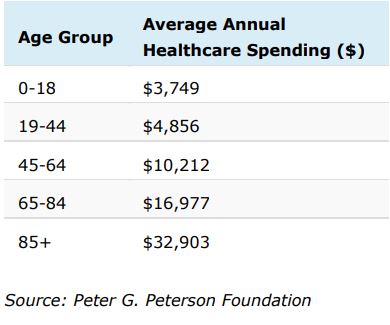

As individuals begin to retire, their risk profiles typically become more conservative. Capital preservation and steady income are the top priorities, and in most cases, portfolios become predominantly weighted towards fixed income and money market securities. Retirees may want to retain an allocation to equities, however. The possibility of outliving one’s savings, also known as longevity risk, is a real possibility— especially given the higher medical costs associated with old age:

According to the data, the average American experiences a sharp increase in medical costs once past the age of 45. This could spell the need for returns higher than what is provided by a fixed income-only portfolio. Maintaining exposure to equities—an asset class that has historically generated higher returns than fixed income—could help to mitigate longevity risk.

Putting It All Together

According to the investor lifecycle, a typical portfolio will transition through three broad stages over one’s lifetime. At each consecutive stage, the types of assets used should be adjusted to reflect the investor’s shifting risk profile. By the final retirement stage, the appetite for risk is often low, and the core of a portfolio will be typically comprised of high quality, income-oriented investments. Careful monitoring of income and expenditures will also be required to reduce longevity risk. While unique circumstances can sometimes warrant a deviation from the three stage lifecycle, its underlying theme still holds true—an investment portfolio should always be optimized to support one’s goals.

Be suspicious of anyone that offers you easy money. Scammers are skilled at convincing you that the

Easy steps to plan and manage how you spend your money. Having a budget helps you to feel in

When we get to the end of another year, we often feel the stress and events of the last 12 months

Level 1, 441 South Road Bentleigh VIC 3204